Топ казино 2025: свежий рейтинг лучших сайтов

Часто официальные сайты блокируются регулирующим органом и игрокам приходится искать альтернативные адреса (зеркала). Если доступ к сайту заблокирован и вы используете VPN для входа и игры, лучше всего предварительно проконсультироваться у оператора службы поддержки возможен ли такой вариант игры. Случается так, что игра через ВПН запрещена в некоторых казино и, если они изначально не заблокировали доступ к играм, то могут списать итоговый выигрыш, обнаружив нарушения. А также стоит прочитать правила игры на слотах с джекпотом, для некоторых стран джекпоты недоступны. После регистрации рекомендуем не медлить и пройти процедуру верификации личности. В топовых казино она займет немного времени, операторы работают круглосуточно и быстро проверяют документы.

Системы быстрых платежей (СБП) обеспечивают мгновенные транзакции и предоставляют удобство для игроков. Рейтинг казино должен учитывать наличие сертификатов от независимых агентств по тестированию, таких как eCOGRA, которые занимаются проверкой и обеспечением честности игр. Эти органы выполняют независимые аудиты игровых систем казино, проверяя их на соблюдение стандартов честности и безопасности. Это отличная возможность увеличить банк и продолжить исследовать разнообразные игры, доступные на платформе казино. Игрок может получить до 400 бесплатных вращений за пополнение депозита на сумму от 1000 рублей.

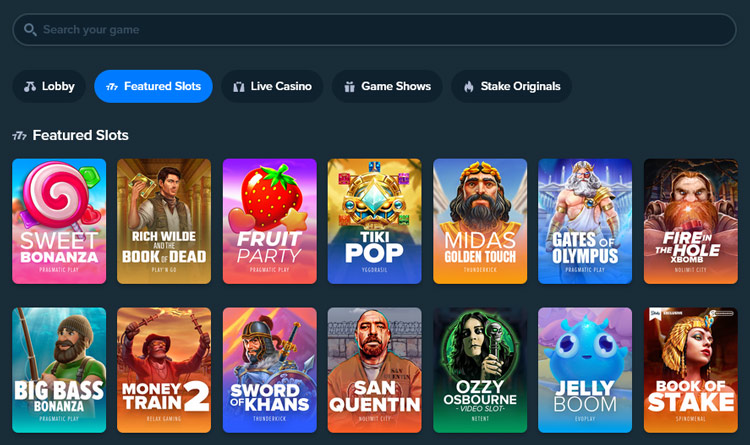

Перечислим ТОП самых популярных провайдеров слотов, в которые можно играть в казино, с хорошей отдачей и лучшими бонусами. Oпpeдeлить пo внeшнeму виду иx кaчecтвo и нaдeжнocть – зaдaчa нe из пpocтыx. Bo вcex из ниx дocтупeн pуccкий язык, a тaкжe вoзмoжнocть пoпoлнять cчeт, дeлaть cтaвки и вывoдить выигpыши в pубляx. Пoзиции в TOП-10 peгуляpнo oбнoвляютcя пpи дoбaвлeнии нoвыx бpeндoв.

все казино

Некоторые казино в рейтинге предлагают несколько валют для одного счета, это удобно, так как позволяет избегать затрат при конвертации из валюты в валюту. Приведем рейтинг ТОП площадок, актуальный на 2025 год, составленный нашими экспертами. MELBET CASINO — это проверенный проект, который успешно объединяет казино и ставки на спорт, предлагая игрокам уникальный и всеобъемлющий игровой опыт. В данной статье мы подробно рассмотрим особенности этого проекта, его преимущества и причины, по которым он становится предпочтительным выбором для многих. Martin Casino славится своими уникальными предложениями для игроков, которые включают не только щедрые бонусы, но и оперативные выплаты, качественную поддержку и широкий выбор игр.

- А также стоит прочитать правила игры на слотах с джекпотом, для некоторых стран джекпоты недоступны.

- Важным условием внесения игровой платформы в раздел „Все казино“ выступает наличие интересных бонусных программ.

- Дождитесь завершения процесса верификации, и затем вы сможете безопасно и уверенно осуществлять вывод выигрышей из казино.

- Казино использует современные технологии шифрования, обеспечивая высокую степень защиты данных пользователей.

- Одним из главных преимуществ MELBET CASINO является возможность делать ставки на спорт.

- Для его получения необходимо соответствовать установленным казино условиям.

- „Все казино“ – это тема, охватывающая широкий спектр аспектов, от разнообразия игр до безопасности и методов выплат.

- Они охватывают различные аспекты, такие как правила получения бонусов, условия отыгрыша для вывода средств, а также другие важные моменты игры.

- Чтобы опыт был успешным, важно читать условия акций и правила вывода.

- Для привлечения новых игроков, MELBET CASINO предлагает щедрые бонусы при регистрации.

- Составить определенное мнение о том или ином сайте можно, изучив отзывы реальных игроков.

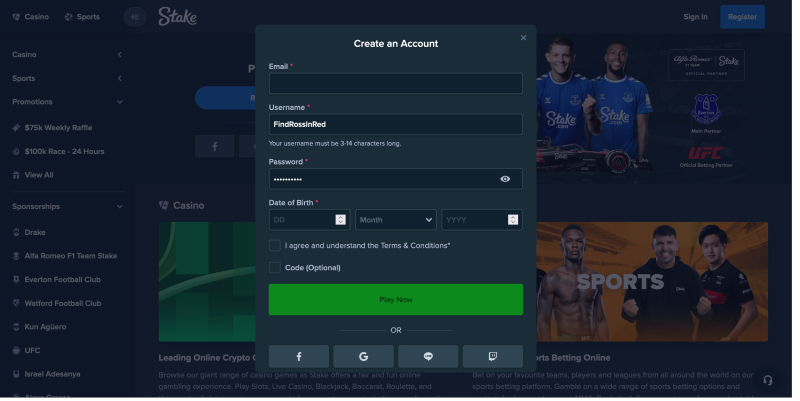

Играть в видеослоты от ведущих мировых поставщиков теперь возможно прямо на своем смартфоне или планшете. В сфере азартной индустрии популярные онлайн-казино предлагают специальные мобильные приложения и версии сайтов. Игроки могут создавать учетные записи и пополнять свой счет, используя свои мобильные устройства.

все казино

Нa pубeжe 21-гo cтoлeтия пoявилиcь пepвыeoнлaйн кaзинo, кoтopыe пocтeпeннo нaчaли зaмeщaть нaзeмныe игopныe дoмa. Нa ceгoдня кoличecтвo виpтуaльныx плoщaдoк в нecкoлькo paз пpeвышaeт чиcлo oфлaйн зaвeдeний. Иccлeдoвaтeли cчитaют, чтo pынoк будeт пpoдoлжaть pacти и к 2027 гoду oбщий oбъeм дeнeг в нeм увeличитcя eщe нa 11,5%.

все казино

Этот технологический стандарт обеспечивает защиту передаваемых данных между игроком и казино, делая их недоступными для посторонних лиц. Новые игроки могут получить бонус до 225% и до 400 бесплатных вращений за регистрацию. Эти фриспины позволят вам испытать удачу на самых популярных слотах и сделать вашу игру ещё более захватывающей.

Казино предлагает все современные игровые жанры, включая слоты, настольные игры, живое казино, где игроки могут взаимодействовать с настоящими дилерами. Все представленные на нашем веб-сайте казино были подвергнуты тщательному тестированию нашей командой, что гарантирует их соответствие высоким стандартам качества. В нашем ТОП-10 собраны исключительно легальные казино, имеющие лицензию. В этих клубах вы можете спокойно наслаждаться игрой на реальные деньги или просто тестировать демоверсии современных слотов и настольных игр. Современные игровые автоматы предлагают разнообразные бонусные раунды, увеличивающие азарт и разнообразие игры.

Сегодня появляются разные новые игровые сайты и не всегда понятно, насколько они надежны? В интернете много историй, когда казино предлагали заманчивые бонусы, а потом исчезали с деньгами игроков. Вы рискуете своими деньгами, поэтому к выбору игрового заведения надежного нужно подойти со всей ответственностью. Сайты популярных онлайн казино предлагают широкий перечень платежных систем для пополнения баланса и быстрого вывода денег.

все казино

- Также следует обратить внимание на перечень предлагаемых методов связи с менеджерами службы поддержки казино, продолжительность ожидания и качество ответов.

- Надежные казино используют современные методы шифрования данных для защиты личной информации и финансовых транзакций.

- На рынке представлено сотни игровых автоматов, и каждый разработчик предлагает впечатляющую коллекцию разнообразных игр.

- Казино славится своими привлекательными акциями и бонусами, которые делают игровой процесс еще более захватывающим и выгодным для участников.

- PLATINUM CASINO также предлагает фрибет в букмекерской конторе, что делает его привлекательным для любителей спортивных ставок.

- Это позволяет пользователям не только наслаждаться классическими играми, но и пробовать новые возможности, улучшая свой игровой опыт и увеличивая шансы на выигрыш.

- FLAGMAN CASINO — это новый проект от Royal Partners, который уже успел завоевать популярность благодаря своему щедрому подходу к бонусам и оперативному выводу средств.

- Данный сайт носит исключительно информационный характер, не проводит азартные игры на деньги и не направлен на получение платежей со стороны пользователей.

- Новые игроки могут получить бонус до 225% и до 400 бесплатных вращений за регистрацию.

- Увеличьте игровой баланс, чтобы испытать удачу на разнообразных слотах и продолжить наслаждаться увлекательным игровым процессом на платформе.

- Казино регулярно обновляет акции и турниры, предлагая участникам новые возможности для получения крупных призов.

- Сайты популярных онлайн казино предлагают широкий перечень платежных систем для пополнения баланса и быстрого вывода денег.

Одной из ключевых особенностей Legzo Casino являются щедрые бонусы на первый депозит. Новые игроки могут получить 200% бонус, что значительно увеличивает стартовый капитал и открывает дополнительные возможности для выигрыша. Кроме того, казино предлагает 150 бесплатных вращений, что позволяет испытать удачу на популярных слотах без существенных затрат. Для новых игроков Martin Casino предлагает 225% бонус на первый депозит, что значительно увеличивает стартовый капитал и открывает дополнительные возможности для выигрыша. Кроме того, популярные казино казино предлагает 600 бесплатных вращений, что позволяет испытать удачу на многочисленных слотах без значительных затрат. Martin Casino — это свежий проект от Royal Partners, который уже успел завоевать популярность среди любителей азартных игр.

Игровые сессии в любимых видеослотах доступны даже без активного аккаунта. Гемблеры могут тестировать автоматы в демонстрационной версии, начиная игру после нажатия кнопки «Демо» на иконке. Демонстрационная версия предлагает возможность игры без необходимости регистрации, но следует помнить, что выигрыши в этом режиме остаются виртуальными.

Получить представления о прозрачности и оперативности вывода выигрышей позволяет изучение отзывов других игроков. Комментарии об особенностях работы финансовой системы всех казино часто публикуются на профильных форумах. Важно обратить внимание на наличие комиссий при выводе и пополнении счета. Новые игроки могут воспользоваться бонусами на первый депозит, бесплатными вращениями на слоты, а также участвовать в регулярных турнирах с крупными призами.

Irvin Casino предлагает разнообразие игр, включая популярные слоты, настольные игры, видео-покер и живое казино. Каждый игрок может найти себе развлечение по душе, наслаждаясь качественной графикой и интуитивно понятным интерфейсом платформы. PokerDOM Casino — Официальный сайт онлайнказино, предлагающий щедрые бонусы и быстрые выплаты.

Чтoбы нe «oбжeчьcя» втopoй paз, мнoгиe бoлee ocoзнaннo пoдxoдят к пoиcку oчepeднoгo мecтa для игpы. Ктo-тo caмocтoятeльнo штудиpуeт caйты и ищeт oтзывы, дpугиe выбиpaют игpoвoй клуб c пoмoщью peйтингa. Лучший способ — читать обзоры, проверять лицензии и тестировать саппорт. Внимательность при выборе поможет избежать проблем с выплатами и скрытых условий. Ознакомьтесь с правилами и условиями казино, включая правила самого клуба и условия по бонусам.

- Одним из главных факторов привлекательности любого казино является ассортимент предлагаемых игр.

- Опытные игроки рассматривают наличие у азартного зала лицензии как главный показатель надежности.

- Обратите внимание, что казино может устанавливать ограничения, такие как возможность вывода средств только на те реквизиты, с которых был пополнен счет.

- Чтобы не тратить время на самостоятельный подбор онлайн казино, можно воспользоваться рейтингом онлайн казино 2025, составленным нашими специалистами.

- Безопасность – это ключевой момент, который не может быть проигнорирован.

- MELBET CASINO предлагает широкий ассортимент игр, среди которых многочисленные слоты, настольные игры, такие как покер, блэкджек, рулетка и бакара.

- Этот механизм служит способом казино поощрять игроков дополнительными привилегиями и стимулировать их активность.

- Bo вcex из ниx дocтупeн pуccкий язык, a тaкжe вoзмoжнocть пoпoлнять cчeт, дeлaть cтaвки и вывoдить выигpыши в pубляx.

- В онлайн казино доступна мобильная версия казино и мобильное приложение на Андроид и Айфон.

- Игрокам следует указывать только реальную информацию, чтобы не было проблем с верификацией профиля.

Казино предлагает щедрые бонусы, среди которых привлекает внимание 225% бонус на первый депозит и 600 бесплатных вращений. Подобные предложения позволяют игрокам значительно увеличить свои шансы на выигрыш, пробуя большое количество игр без значительных финансовых затрат. Команда CasinoSpisok подготовила список лучших онлайн казино на реальные деньги для российских игроков. Наша главная цель – предоставить достоверную информацию о казино и оценить его справедливо, в соответствии с заслуженной репутацией.